after registered with lhdn how to check income tax number

You can get your income tax number by registering as a taxpayer on e-Daftar and you can get your PIN after that either online or by visiting a LHDN branch. Visit the nearest LHDN Office.

Think Twice Before You Click Avoid From Tax Scammers And Hackers Www Reg Asia

The next thing you should do is to file your income tax do it online.

. Enter the employees Identification Identity Card Police Army or Passport No. If you do not have an income tax number yet please register for one either by. Check your application status.

Your income tax number and your PIN. Call the LHDN Inland Revenue Board and be prepared to give them your IC or passport number. Within 3 working days after completing an online application.

If you are paying your staff more than RM3000 per month deduct PCB from their pay remit it to LHDN. 03-8911 1000 Local number 03-8911 1100 Overseas number Not registered. Select Search for property.

Login for First Time. Please Check Your Income Tax No. Example of application number will be given after online registration form has been received.

Visit the nearest LHDN Office. E - P a y m e n t e-Payment via FPX. E-Daftar is also accessible through MyTax a new service portal that was launched by the LHDN so that taxpayers can conveniently access their latest information without having to visit the boards office.

Please quote your application number ProblemsComplaintsComments. E-Filing Organization Download CP55B CP55C. Click Proceed with search.

Call 03-8911 1000 local or 03-8911 1100 overseas. Income Tax No. Payroll reference numbers are.

For Further Info Please Move Your Cursor Towards. Login to e-Filing ezHASiL Portal. Contact 03-8913 3800.

Please used the given application number to check your application status. Alternatively you can check via e-Daftar or give the LHDN a call. Search using your property address and your tax reference number ie.

Kindly remember to attach Income Tax Number latest address and a copy of National Registration Card MyKad both front and back. Kindly remember to attach Income Tax Number latest address and a copy of National Registration Card MyKad both front and back. Followed by Police No Army No.

Cukai Pendapatan Anda Terlebih Dahulu. NRIC FIN number or your property tax reference number. Then she will ask you few questions like your house address where you work etc to make sure you are the real owner of the tax number they not allow you help other people to request the tax number.

Adalah medan mandatori. Once you have completed and uploaded the required documents click Submit and LHDN will provide a Pin Number for you to review the application after 7 working days. When will you get the Income Tax Reference No.

If no matched record is found against your MyKad number click on the e-Daftar link. Untuk Penerangan Medan Berkenaan Sila Gerakkan Tetikus ke. Cukai Pendapatan Anda Terlebih Dahulu.

Applying at the nearest LHDN office. 22 Business registration certificate for Malaysian citizen who carries on business. Make sure your email address is correct because LHDN will send a reference number to your email.

Through mail or fax to any nearest LHDN office. Gone are the days of queuing up in the wee hours of the. After the employer tax reference number has been registered the employer is required to determine MTD calculation is accordance with Income Tax Deduction From Remuneration Rules 1994 MTD Rules according to.

You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready. To open income tax file number with LHDN once the company start to issue bill invoice. Type in the verification code shown in the image.

After you receive a PIN Number you can proceed to Login for the first time. E - Filing Tax Agent First Time Login Login Download CP55 CP55A. Application form to register an income tax reference number can be obtained from the nearest Income Tax Offices.

Check out our step-by-step guide on registering as a first-time taxpayer. Daftar Pembayar Cukai-Lembaga Hasil Dalam Negeri. To register with IRB LHDN as Employer E number when start hiring staff.

Filling in the e-Daftar form online or. November 17 2021. In the box provided.

Once approved you will receive an email containing your income tax number. Through mail or fax to any nearest LHDN office. Ask Jamie your virtual assistant.

Check the application status using the application no. Contact the income tax officer at 03-4289 3000 and request for your Tax number by providing the IC number. The income tax number is used to determine whether you owe personal or corporate income taxes.

A s s i s t a n c e e-Filing Handbook e-Filing User Guide m-Filing User Guide e-Filing FAQ Prefill Data. How to file your personal income tax online in Malaysia. 23 Passport and business registration certificate for non-citizen who carries on business.

Steps to Check Outstanding Tax. Login for First Time. Lembaga Hasil Dalam Negeri MalaysiaInland Revenue Board Of Malaysia.

You can file your taxes on ezHASiL on the LHDN website. Identification Passport No. Income tax deadline 2021.

Before you can file your taxes online there are two things that you will need. Enter your MyKad number and Security Code as shown on the page and click Hantar. Fill in the required information.

After you receive a PIN Number you can proceed to Login for the first time. To check whether an Income Tax Number has already been issued to you click on Semak No. Contribute EPF.

Try to give priority to New Identity Card No. Key in the employees income tax number in this item.

Tax Clearance In Malaysia A Detailed Overview Of Malaysian Tax Finance Apps Best Finance Apps Tax

Iincametaxncome Tax Lhdn Filing Taxes Income Tax Tax Guide

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com Tax Guide Income Tax Tax Refund

How To File Income Tax In Malaysia 2021 Lhdn Youtube

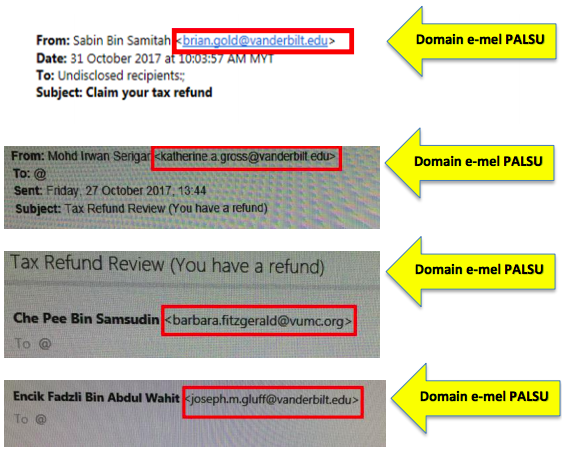

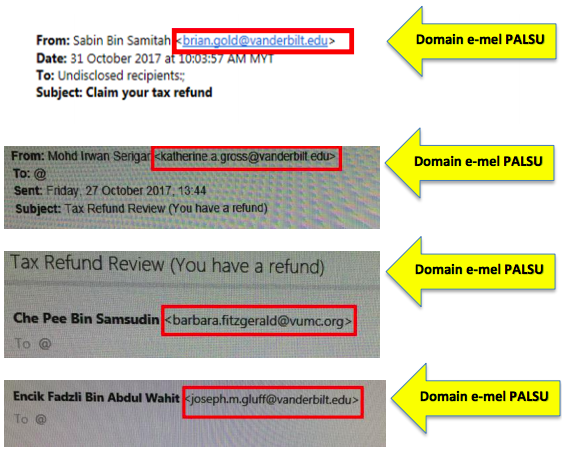

Finance Malaysia Blogspot Tax Refund Email Sent By Lhdn So Good Ah

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Belum ada Komentar untuk "after registered with lhdn how to check income tax number"

Posting Komentar